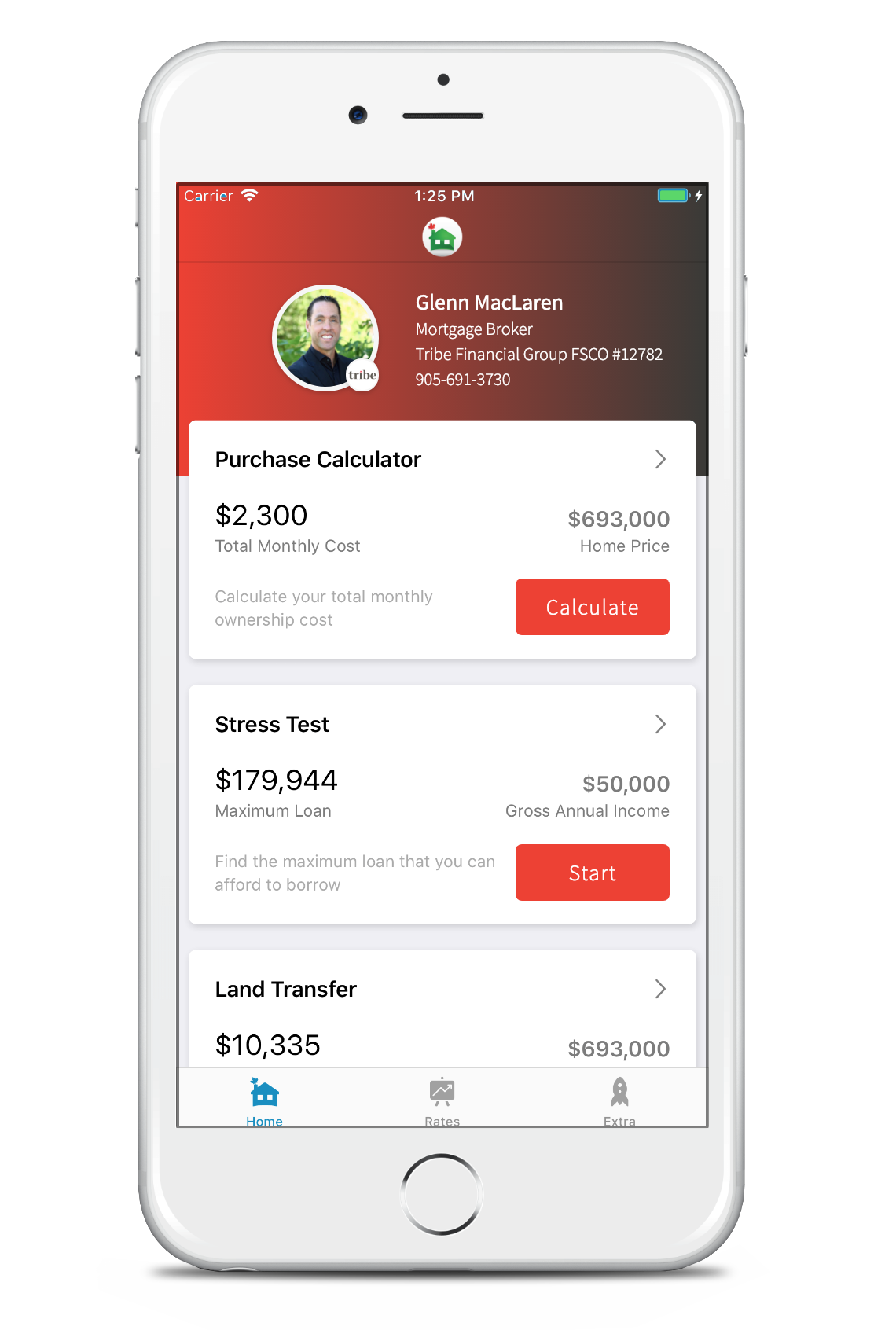

Glenn MacLaren

COO/ Co-Founder/ Mortgage Agent

Watch Glenn’s Video

There’s strength in numbers.

Confidence, too. And the confidence that comes with having the numbers on your side starts with having the right people on your side. People who speak numbers, speak your language and whose reputations speak for themselves. People who understand your goals and work with you to meet them. People like you. For trusted financial advice and service that makes you feel like you belong.

Join the tribe.

Mortgage

Services.

Customer Care

I believe that my responsibility as a mortgage expert goes well beyond simply arranging your mortgage financing. My job is to ensure that you feel confident in the mortgage process and make decisions that best suit you and your tribe.

Education

In order for you to feel confident about the mortgage process and make the best decisions for your tribe, you have to feel at ease and be able to ask questions. I stay in touch with you throughout the entire process, provide information up front, but also make myself available whenever you need me!

Best Mortgage Products

Being a part of the tribe has advantages. Access to the best lender products available anywhere in Canada is one of them. We use our extensive corporate networks to ensure you get the best mortgage product. It pays to belong.

Lenders.

We have developed excellent relationships with several lenders, let’s figure out which one has the best products to offer you!

What Clients Are Saying

Federal Budget Perks for First-Time Homebuyers & New Mortgage Fraud Measures

April 2024 has been an active month for news impacting mortgage borrowers! The 2024 federal budget contained some benefits for first-time homebuyers, which is a step in the right direction. In addition, the federal government announced big plans the mortgage industry...

Have You Taken Advantage of the First Home Savings Account?

Saving for a down payment is often one of the greatest barriers to homeownership. Fortunately, a First Home Savings Account (FHSA) encourages Canadians to intentionally plan ahead for your entrance into the housing market. First introduced by the federal government...

Calculating Your First-Time Homebuyer Budget

Buying your first home is extremely exciting, but it also takes a lot of planning, including building a realistic budget that helps ensure you can afford to carry all the expenses that come along with homeownership. Here are the key homebuying costs to include in your...

You Belong, Let’s Talk